Carrier liability insurance

Carrier liability insurance is a type of insurance that protects the carrier against legal liability claims if damage occurs to the goods entrusted to them during transport.

Securing transports and companies

Carrier liability insurance - what is it?

In the transportation and logistics sector, companies are exposed to a variety of risks on a daily basis. If goods or third-party property are damaged during transportation, considerable liability claims can quickly arise - particularly in accordance with the relevant national and international regulations.

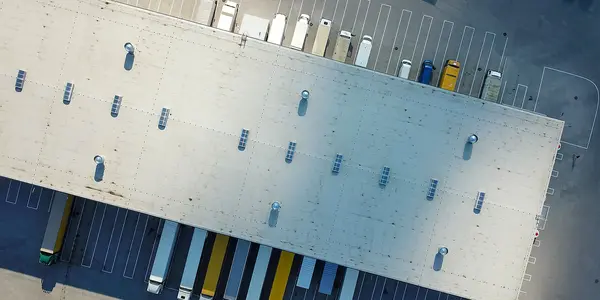

Facts & Figures from Europe

Street

In Europe, most goods are still transported by road - and therefore by truck. New risks have emerged in recent years in particular: Freight embezzlement by so-called "fake carriers", robberies even of less valuable goods such as food - triggered by global inflation rates - and the unauthorized entry of refugees into truck cargo holds.

With transport liability insurance cover from LUTZ ASSEKURANZ, you are optimally protected for precisely these and many other challenges. We think one step ahead - and offer you comprehensive cover out of the box, without you having to worry about it.

Air

Fast, light and usually of high value - this is how freight that is typically transported by air can be characterized. Fittingly, the liability limit of the Montreal Convention is also remarkably high: at 26 SDR per kilogram of damaged or lost goods (last increased on 28.12.2024), it is significantly higher than the regulations for other modes of transport.

With transport liability insurance cover from LUTZ ASSEKURANZ, you are ideally positioned: Your cover grows automatically and reliably takes current developments into account - without any additional effort on your part.

Sea

The ocean-going vessel is still the backbone of international supply chains - and is considered one of the most important means of transportation in global trade. At the same time, the risks on the high seas are manifold: from storms and accidents to strandings and piracy. When reading current media reports, it is not uncommon to get the impression that even this "safest means of transportation" is now exposed to greater dangers than ever before.

However, with LUTZ ASSEKURANZ's transport liability insurance cover, you are on the safe side. We cover liability issues under all common maritime law regimes - whether Hague Rules, Hague-Visby Rules, Hamburg Rules, national regulations or bill of lading regulations. This means you benefit from comprehensive protection that offers you security and reliability worldwide.

River

Europe's most popular waterway, the Danube, is not just a tourist attraction - the transportation of goods on it has also become an important economic factor. After all, the Danube connects ten countries and flows into the Black Sea.

The relevant international conventions (including the CMNI Budapest Convention) regulate the liability of inland waterway carriers. With transport liability insurance cover from LUTZ ASSEKURANZ, you need not fear financial shipwreck - we ensure that your transports are covered without risk.

Railroad

The political promotion of rail as a means of transportation is progressing constantly - numerous infrastructure projects are intended to further strengthen the shift of goods from road to rail in the future. At the same time, new connections are being created worldwide: China in particular is investing massively in the expansion of modern "Silk Roads".

Freight forwarders who take advantage of these opportunities at an early stage benefit twice over - from new opportunities in the transport business and from the flexibility of LUTZ ASSEKURANZ's transport liability insurance cover. Whether territorial with worldwide protection or legal according to common liability bases such as CIM / COTIF or SMGS: we offer tailor-made solutions that guarantee security and reliability.

Warehouse

Whether procurement warehouse, distribution warehouse, supply warehouse, transshipment warehouse, interim warehouse or order picking warehouse - LUTZ ASSEKURANZ always has the right liability insurance for the operating freight forwarder. We also offer reliable protection in countries with special legal frameworks that may be considered "exotic" in terms of warehousing law - such as Austria with the SVS.

Even customs warehouses can be flexibly integrated into the insurance cover. Our customers benefit from tailor-made solutions that guarantee security, flexibility and reliability.

FAQ on carrier's liability insurance (CMR/road)

We have compiled the most frequently asked questions about carrier liability insurance for you in our FAQ. Our experts will also be happy to provide you with individual advice.

Carrier's liability insurance is an insurance policy that covers the liability of the carrier - for national and cabotage road freight transportation in accordance with national freight law and for international transportation in accordance with the CMR.

No, LUTZ ASSEKURANZ is an insurance broker who arranges the insurance contract and takes over the contract administration on the basis of powers of attorney. The risk carrier is the insurance company indicated on the policy.

First, the carrier fills out any risk analysis questionnaire and submits this together with the application to LUTZ ASSEKURANZ after having read and taken note of the insurance conditions. The insurance policy is then drawn up on the basis of the agreed conditions. The policyholder then receives a premium invoice, which must be paid on time and in full for the insurance cover to take effect under the contract concluded.

The insurance contract generally runs until December 31 of the following year in which it began - for example, from August 1, 2025 to December 31, 2026. The contract is automatically extended for a further year unless it is terminated by September 30 at the latest by means of a formal notice of termination by return receipt letter.

The insurer accepts justified claims made against the carrier as the policyholder and defends against unfounded claims - if necessary by providing a lawyer and paying the legal and litigation costs incurred.

The insurer shall always pay its benefits - whether by satisfying justified claims or defending against unjustified claims - if the insurance premium has been paid in full and on time after the premium has been written, the required claims documents are available, the necessary information has been provided and there are no breaches of obligations or insurance exclusions.

The insurer grants insurance cover within the scope of the agreed insurance conditions. This means that the first step is to check whether and to what extent the carrier is liable as the policyholder. If such liability exists, compensation is paid in accordance with the statutory liability provisions, within the scope of the conditions and sums insured specified in the policy.

The goods-in-transit insurance covers the property damage interest of the party interested in the goods, the carrier's liability insurance covers the liability of the carrier.

The insurer will not pay if the insured carrier is not liable. In such cases, claims for damages are defended. This may be the case, for example, in the event of an "unavoidable event" as defined in Art. 17(2) CMR - for example, a traffic accident that was 100% the fault of a third party, an armed robbery that could not be prevented, or similar situations. There is also no liability in accordance with Art. 17(4) CMR, for example in the event of defective packaging of the goods or incorrect loading by the sender. If, despite such an exclusion of liability, freight is unjustifiably withheld from the carrier, this freight withholding will be claimed in consultation with the carrier.

The insurer shall also not make any payment if it is released from liability due to non-payment or late payment of the premium or due to a breach of obligation - for example if the claim was not reported in good time or was not reported truthfully. There is also no insurance cover if there is another exclusion of cover specified in the insurance conditions.

The insurance conditions stipulate that the plaintiff has a choice: Either he appeals to the court responsible for commercial matters in Vienna or he sues the insurer at the court responsible for the policyholder's registered office.

If, in the event of damage, it turns out that freight has been wrongly withheld as compensation for the damage (e.g. if the carrier is exempt from liability under Art. 17 CMR), the client is requested to pay the outstanding freight. If necessary, legal action will also be taken against the freight debtor in consultation with the carrier. In this case, the insurer will provide a lawyer and assume the associated costs.

In simple terms, the carrier is liable for damage caused by slight negligence, provided there is no exclusion of liability in accordance with Art. 17 CMR. In this case, liability is limited to 8.33 special drawing rights (SDR) per kilogram of gross weight in accordance with Art. 23 and 25 CMR. This currently corresponds to around 9.75 euros per kilogram (kg).

Example:

If the lost goods weighed 100 kg and had a goods value of 8,000 euros, the carrier's liability when applying the SDR rule is:

100 kg x 8.33 SDR = 833 SDR → approx. 975 euros.

If the client now compensates the entire damage of 8,000 euros by retaining outstanding freight, although the carrier is only liable for 975 euros, LUTZ ASSEKURANZ demands repayment of the difference of 7,025 euros. If no payment is made, the outstanding freight will be claimed in court - in consultation with the carrier. The insurer will provide a lawyer for this and cover the costs.

The best advice in such cases is to take out goods transportation insurance in the future. If the sum insured is selected correctly and within the scope of the insurance conditions, this will generally cover the full loss. In this way, financial risks can be much better covered than by the legally limited liability of the carrier.

Yes, in principle, liability for gross negligence is also insured. However, this does not apply if the policyholder himself or his legal representatives have caused the damage intentionally or through gross negligence. An exception is made when they drive trucks themselves and violate the road traffic regulations through gross negligence, as long as they are not under the influence of drugs or alcohol. In such cases, insurance cover remains in place. Another prerequisite is that vicarious agents have been carefully selected, instructed and supervised. It is worth noting that even damage caused intentionally by the driver is covered under certain conditions.

Depending on the basis of liability and the specific claim, the sum insured per vehicle and claim can be up to 1,200,000 euros. The exact regulations and requirements are set out in the respective insurance conditions.

In the event of damage, it is particularly important to inform LUTZ ASSEKURANZ immediately. LUTZ ASSEKURANZ will coordinate the next steps with the carrier - for example, whether an average adjuster should be called in. As the policyholder, the carrier is obliged to submit the claim documents as quickly as possible, to provide all necessary information and, if necessary, to secure any recourse against third parties. The exact procedure can be found in the respective insurance conditions. All documents must be sent to LUTZ ASSEKURANZ Versicherungsvermittlung Ges.m.b.H., which will process the claim.

If a carrier commissions a sub-carrier, special care is required. Before awarding the transport contract, it should be checked whether the sub-carrier has sufficient carrier's liability insurance. It is advisable to request a copy of the insurance policy or an insurance confirmation, including confirmation that the insurance premiums have been paid on time and in full.

If the sum insured is sufficient - at least EUR 300,000 is considered a guideline - it is sufficient if the carrier also takes out its own carrier's liability subsidiary insurance. This makes sense, as the sub-carrier's insurer could be released from liability for various reasons despite all precautionary measures.

If the sub-carrier cannot provide evidence of appropriate insurance cover before the order is placed, it should either not be commissioned or the carrier should take out so-called carrier's liability insurance ("third-party carrier insurance") for it at its own expense and deduct the premium from the freight remuneration.

It is equally important that the transport order placed is passed on to the sub-carrier in every detail. For example, if the client specifies that two drivers are to be used, that a box body is to be used or that rest breaks may only take place in guarded parking lots, these specifications must be passed on to the subcontractor in writing.

Subsidiary insurance only comes into play if other existing insurance policies do not cover the damage or do not cover it in full - regardless of who has taken out these other insurance policies. It is considered subordinate and only comes into effect if all primary insurances refuse to pay out or are insufficient.

Example:

A carrier has taken out carrier's liability subsidiary insurance and commissions another carrier with the transportation. This carrier has its own carrier's liability policy. In the event of a claim, the insurance of the actual carrier is used first to settle the claims of the original client. This also applies if goods transportation insurance also exists. Only if these primary insurances do not pay will the subsidiary insurance of the commissioning carrier take over.

No, this is expressly prohibited under Art. 41 CMR. The CMR is mandatory law and may not be amended or excluded in whole or in part - with the exception of the provisions in Art. 37 and 38. According to Art. 41 Para. 1 CMR, all agreements that directly or indirectly deviate from the provisions of the Convention are null and void and legally ineffective. However, matters that are not regulated by the CMR, such as the prohibition of offsetting freight against disputed damages, can be regulated by contractual agreements between the parties.

Carriers can take out ferry insurance through LUTZ ASSEKURANZ if they use ferries. It serves to protect against the risk of having to make contributions in the event of so-called general average.

General average is declared when the ship and cargo are in joint peril - for example due to a storm, fire or other emergency - and measures are taken to rescue both. The resulting costs are then shared between all parties involved. This means that the carrier must also bear a share of the costs, depending on the value of his vehicle and the cargo. With ferry insurance, the insurer covers these costs.

Yes, this is possible. On behalf of the interested party, the carrier can take out goods transportation insurance through LUTZ ASSEKURANZ. This provides additional cover for transportation - direct and uncomplicated: cargo-declaration(at)lutz-assekuranz(dot)eu

A "guarded parking lot" within the meaning of the insurance conditions (AVB-VH 2015-INT) is a parking lot that is monitored around the clock, i.e. 24 hours a day, either by a video system or personnel. It is also considered guarded if it has an entry and exit control system that is also operated continuously.

The answers in the FAQ are deliberately kept short for reasons of space. For further information, we recommend taking a look at the insurance conditions.